Pakihi Māori Spotlight: Green Light Escrow

We’re shining a spotlight on three Pakihi Māori (Māori businesses) that have been through the Kōkiri programme, a kaupapa Spark has supported for several years. Maxwell Semmons-Russel (Te Arawa and Te Rarawa) is a plumber, business owner and the entrepreneur behind Green Light Escrow. We spoke to Max to hear more about his journey.

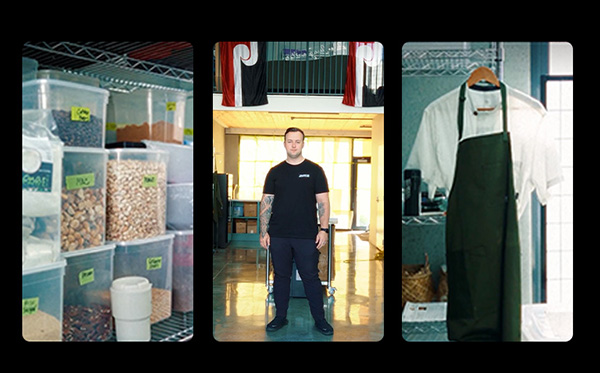

Max has been working in trades for 20 years, and in the last five years he has been running his own business, KPA Plumbing. But it hasn’t always been smooth sailing. When he started, he often had trouble getting paid on time for his work.

“I just thought it wasn't right, how can I make something to fix that problem.”

Max saw that there was a huge problem in the construction industry with tradespeople not getting paid for their work. He also recognised that on the flip side, people like homeowners and developers also often had issues with not getting what they had paid for.

So he started researching, looking for ways to get paid upfront, despite people telling him it was impossible. In construction, Max says it’s very much “do the work, do the mahi first – then get paid later.”

When one of his friends mentioned the word ‘escrow’ it opened up a world of possibilities for Max. He started compiling information through Google and Youtube to find out all he could. He found that companies in the places around the world like the States, Nigeria and India were doing it. “And then I was wondering why no one had done it here.”

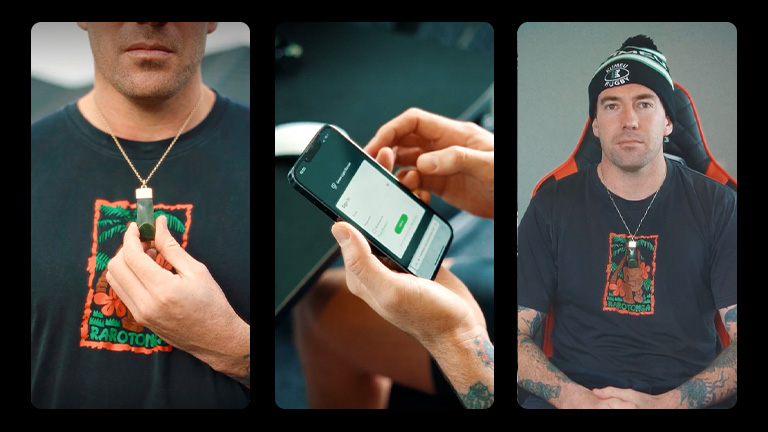

And so that’s what Max did. He created Green Light Escrow, a fintech (financial technology) company that helps protect both the tradesperson and the client.

Max says a defining moment in his journey was going through a business accelerator programme. He was helped with creating a roadmap, learning what he needed to do and how to refine his emerging business.

“They helped me really like pinpoint and zone my idea in.”

Green Light Escrow has been growing its client base steadily. Despite it being created to ease a pain point for trades, Green Light Escrow can be used by a wide range of professions or large purchases. “You could trade a potato on there… or like a car… you can trade anything through there.”

We asked Max what advice he has for rangatahi for building their career or even starting a start-up themselves. He says that it’s key to accept help from those around you. Whether it’s going through an accelerator programme or gaining insights and feedback from your peers, connections will help.

He also says it’s good to have something you are passionate about at the base of all of it. For Max, he has his trade. Then once you start something, stick at it and see it through, whether it’s an apprenticeship, university or an accelerator programme. Even Max himself has wanted to give up at times, but he has stuck to it and is now running his business with more developments on the horizon. “I've almost given up a few times. Even after Kōkiri, I was like, this is too hard.”

Max is optimistic about the future of Green Light Escrow. While the plumbing business keeps him entertained and helps him support his family, he feels that Green Light is his higher purpose.

“I'd like to see Green Light take off because I know it could help a lot of people.”

After the past six months of beta testing, with rounds of feedback and suggestions from the community, the Green Light Escrow app is now live.

To learn more about Max and Green Light Escrow head to their website. Visit Green Light Escrow